Nepal does not have a centralized CKYC system that is exactly like India’s CKYC. However, the country follows a robust KYC process mandated by the Nepal Rastra Bank (NRB). Here’s a step-by-step guide to the typical KYC process in Nepal, which could serve as a basis for a future CKYC system:

Step-by-Step KYC Process in Nepal

- Customer Onboarding:

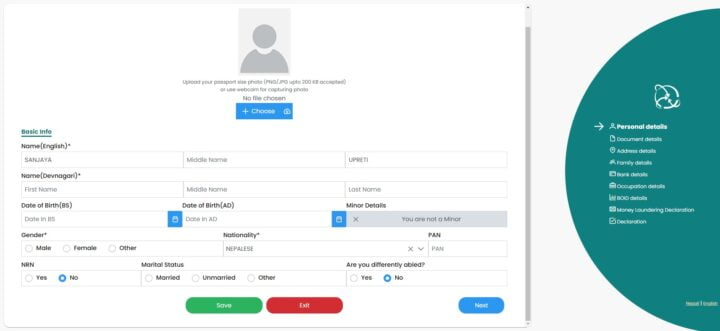

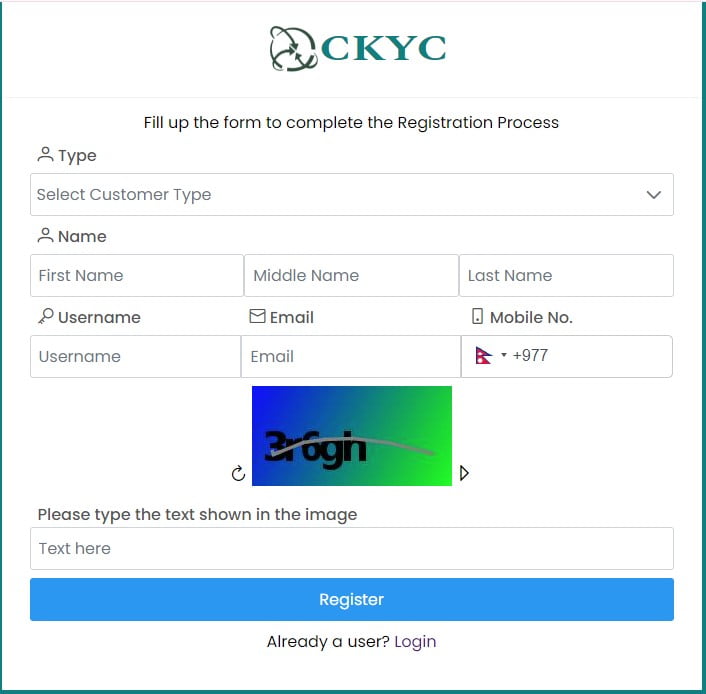

- Application Form: The customer fills out a KYC application form provided by the financial institution.

- Personal Details: The form requires personal details such as name, address, date of birth, contact information, occupation, and income details.

- Document Submission:

- Proof of Identity: The customer must submit a copy of a government-issued identity document, such as a citizenship certificate, passport, or driving license.

- Proof of Address: The customer provides a copy of a document showing their address, such as a utility bill, bank statement, or rental agreement.

- In-Person Verification:

- Physical Presence: The customer visits the financial institution branch in person for identity verification.

- Biometric Verification: Some institutions may take biometric data such as fingerprints or photographs for further verification.

- Document Verification:

- Validation: The financial institution verifies the authenticity of the submitted documents.

- Background Check: A background check ensures the customer has no history of fraudulent activities.

- Risk Profiling:

- Customer Risk Assessment: The institution assesses the customer’s risk level based on their profile and the nature of their transactions.

- Risk Category Assignment: Customers are categorized into different risk levels (low, medium, high) to determine the extent of monitoring required.

- Account Activation:

- Approval: The account is approved once the KYC process is complete and the customer is deemed legitimate.

- Account Setup: If applicable, the customer’s account is activated, and account details, including Internet banking access, are provided.

- Ongoing Monitoring:

- Transaction Monitoring: The institution continuously monitors customer transactions to detect unusual or suspicious activity.

- Periodic Updates: Customers are required to update their KYC information periodically or whenever their profile significantly changes.

- Reporting to the Financial Information Unit (FIU):

- Suspicious Transaction Reporting: Any suspicious transactions detected are reported to the Financial Information Unit of Nepal as part of AML/CFT regulations.

- Compliance: Financial institutions comply with all regulatory requirements and report accordingly.

Towards CKYC in Nepal

To move towards a CKYC system in Nepal, the following steps could be considered:

- Centralized Repository:

- Establish a centralized database to store KYC records of all customers across financial institutions.

- Ensure data security and privacy measures are robust.

- Digital KYC (e-KYC):

- Implement digital KYC processes to streamline the collection and verification of customer information.

- Use biometric and digital signatures for remote verification.

- Inter-Institutional Coordination:

- Develop protocols for sharing KYC data among financial institutions to avoid duplication.

- Create a unified KYC form accepted by all financial institutions.

- Regulatory Framework:

- Amend existing regulations to mandate the use of a centralized KYC repository.

- Provide guidelines for the implementation and use of CKYC.

- Technology Infrastructure:

- Invest in technology infrastructure to support the CKYC system, including secure databases and real-time data access.

- Training and Awareness:

- Train financial institution staff on the new CKYC processes and systems.

- Educate customers about the benefits and requirements of CKYC.

By following these steps, Nepal can enhance its KYC process and potentially develop a centralized CKYC system to improve efficiency and reduce redundancy in the financial sector.

CKYC in Nepal: Frequently Asked Questions (FAQ)

1. What is CKYC?

CKYC (Central Know Your Customer) is a centralized repository for KYC records of financial sector customers. It aims to streamline the KYC process, reduce duplication, and ensure a uniform standard across all financial institutions.

2. Does Nepal have a CKYC system?

Currently, Nepal does not have a centralized CKYC system like India. However, there are discussions and potential plans to develop such a system.

3. What is the current KYC process in Nepal?

The current KYC process in Nepal involves the following steps:

- Customer onboarding with a KYC form.

- Submission of identity and address proofs.

- In-person verification at the financial institution.

- Document and background verification.

- Risk profiling and account activation.

- Ongoing transaction monitoring and periodic KYC updates.

- Reporting suspicious transactions to the Financial Information Unit (FIU).

4. What documents are required for KYC in Nepal?

For KYC in Nepal, customers typically need to provide:

- Proof of Identity: Citizenship certificate, passport, or driving license.

- Proof of Address: Utility bill, bank statement, or rental agreement.

5. Why is KYC important?

KYC is crucial for:

- Verifying the identity of customers.

- Preventing money laundering and financial fraud.

- Ensuring compliance with legal and regulatory requirements.

- Safeguarding financial institutions from illicit activities.

6. What are the benefits of a CKYC system?

A CKYC system offers several benefits:

- Efficiency: Streamlines the KYC process across institutions.

- Cost Reduction: Eliminates redundancy and reduces administrative costs.

- Standardization: Ensures uniform KYC norms.

- Convenience: Simplifies account opening for customers by reducing repetitive documentation.

7. How does CKYC enhance customer convenience?

With CKYC, once a customer completes KYC with one institution, their KYC details are stored in a central repository. Other financial institutions can access this information, making it easier for customers to open new accounts or avail of financial services without resubmitting documents.

8. How is customer data protected in CKYC?

A CKYC system ensures robust data protection through:

- Secure storage of KYC records.

- Controlled access to customer data.

- Compliance with data protection regulations to ensure privacy and security.

9. What steps is Nepal taking towards CKYC implementation?

To move towards CKYC, Nepal is considering:

- Establishing a centralized KYC repository.

- Implementing digital KYC (e-KYC) processes.

- Developing inter-institutional data sharing protocols.

- Updating regulatory frameworks to support CKYC.

- Investing in technology infrastructure.

- Training financial institution staff and educating customers.

10. What is e-KYC, and how does it differ from traditional KYC?

e-KYC (electronic KYC) is the digital version of KYC, allowing for online verification of identity and address using digital documents and biometric authentication. It differs from traditional KYC, which requires physical document submission and in-person verification.

11. Who regulates KYC and potential CKYC in Nepal?

The Nepal Rastra Bank (NRB), the central bank of Nepal, regulates KYC processes and will likely oversee the development and implementation of a CKYC system, ensuring compliance with AML/CFT standards.

By understanding these FAQs, customers and financial institutions in Nepal can better navigate the current KYC landscape and anticipate the potential benefits and changes brought by a future CKYC system.