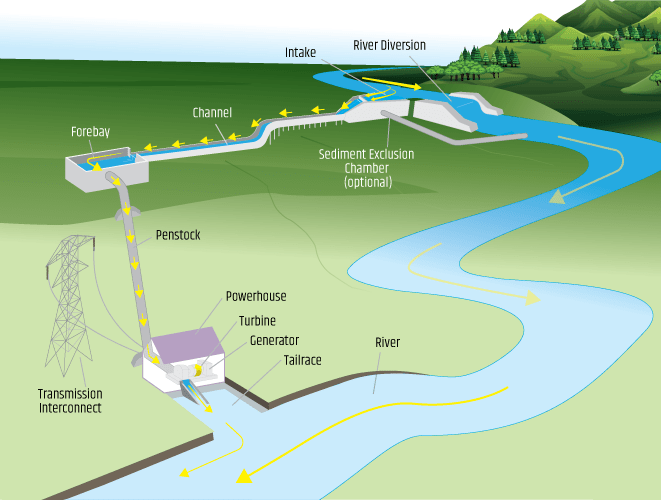

The registration process for hydropower projects in Nepal as of 2024 The registration process for hydropower projects in Nepal as of 2024 involves several steps typically outlined by the Department of Electricity Development (DoED). With its vast water resources and significant hydropower potential, Nepal offers numerous opportunities for investment in hydropower projects. While bureaucratically...