Company Registration Process in Nepal

Company Registration in Nepal involves several steps and adherence to the Office of the Company Registrar (OCR) regulations under the Ministry of Industry, Commerce, and Supplies. Here’s a brief description of the process:

Step 1: Determine the Type of Company

- Private Limited Company: Most common, ideal for small to medium-sized businesses. Requires at least one but no more than 101 shareholders.

- Public Limited Company: Suitable for larger businesses aiming to raise capital from the public. Requires at least seven shareholders.

- Non-profit Organization: Registered under company law for charitable purposes.

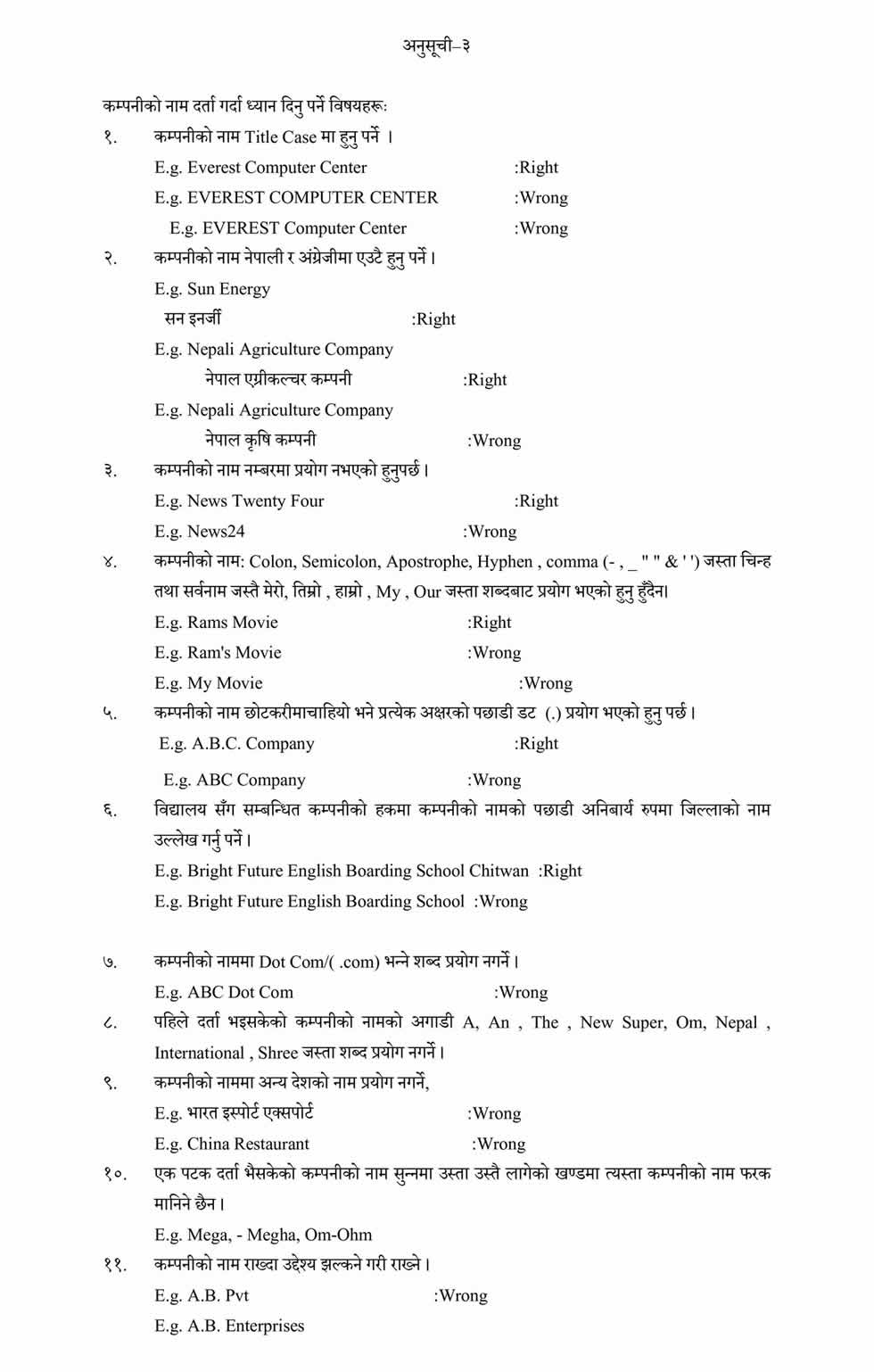

Step 2: Name Reservation

Please choose a unique name for the company and submit it to the OCR for approval. This ensures the name is not already used and complies with naming regulations.

- Visit the Office of the Company Registrar (OCR): Go to the OCR’s website (ocr.gov.np).

- Create an Account: Register for an account to access the online services.

- Submit a Name Reservation Request: Fill out the form to reserve a company name. Ensure the name is unique and complies with the naming guidelines.

- Pay the Fee: Pay the prescribed fee for name reservation.

- Approval: Wait for approval, which can take a few days. Once approved, the name is reserved for 35 days.

Step 3: Prepare Documents

- Memorandum of Association (MOA): Draft the MOA, detailing the company’s objectives, capital, and share distribution.

- Articles of Association (AOA): Draft the AOA, outlining the company’s internal rules and regulations.

- Promoters’ Details: Collect the personal details of all promoters, including their citizenship certificates.

- Other Documents: Include consent letters from directors, a copy of the promoter’s minutes, and, if applicable, the resolution of the promoter company.

Step 4: Submission of Application

- Log In to OCR Portal: Use your account to log in to the OCR portal.

- Fill out the Registration Form: Complete the online registration form with the necessary details.

- Upload Documents: Upload scanned copies of the MOA, AOA, and other required documents. The documents usually include:

- Memorandum of Association.

- Articles of Association.

- Personal identification documents of shareholders and directors.

- Letters from directors.

- Pay the prescribed registration fee based on the company’s authorized capital.

Step 5: Verification and Registration

- The OCR reviews the application and documents. If everything is in order, the OCR issues a certificate of incorporation.

Step 6: Post-Registration Compliance

- PAN/VAT Registration: Obtain a Permanent Account Number (PAN) and register for Value Added Tax (VAT) with the Inland Revenue Department if applicable.

- Bank Account: Open a corporate bank account in the company’s name.

- Social Security Fund Registration: Register with the Social Security Fund for employee welfare contributions.

- Other Licenses and Permits: Additional sector-specific licenses or permits may be required depending on the business type.

Step 7: Operational Compliance

- Statutory Registers: Maintain statutory registers as required by the Companies Act.

- Annual General Meetings: Conduct Annual General Meetings (AGMs) as per the regulations.

- Annual Filings: File annual returns and financial statements with the OCR.

- Compliance with Tax Laws: Ensure compliance with tax laws, including timely filing tax returns and payment of dues.

Following these steps, you can successfully register and operate a company in Nepal. Always seek legal or professional assistance to ensure compliance with all regulatory requirements.

Key Points to Consider:

- Foreign Investment: Foreign investors must obtain approval from the Department of Industry and the Nepal Rastra Bank to bring in foreign capital and register a Company in Nepal.

- Compliance: Companies must comply with ongoing regulatory requirements such as annual general meetings, annual filings, and tax compliance.

Benefits of Registering a Company in Nepal:

- Legal Recognition: Offers legal identity and protection for the business.

- Limited Liability: Limits the liability of shareholders to their share capital.

- Access to Funding: Facilitates access to bank loans and other forms of financing.

- Credibility and Trust: Enhances the credibility and trustworthiness of the business.

Following these steps and ensuring compliance with all legal requirements, you can successfully register a company in Nepal and legally start your business operations.

Frequently Asked Questions (FAQ) on Company Registration in Nepal

1. What types of companies can be registered in Nepal?

- Private Limited Company: The most common type, suitable for small to medium-sized businesses.

- Public Limited Company: Suitable for large businesses, allowing the company to raise capital from the public.

- Non-Profit Company: Established for charitable, social, or non-profit purposes.

2. What is the process for reserving a company name?

- Online Application: Submit a name reservation application through the Office of the Company Registrar (OCR) website.

- Fee Payment: Pay the prescribed fee for the name reservation.

- Approval: Once approved, the name is reserved for 35 days.

3. What documents are required for company registration?

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Promoters’ Details: Including citizenship certificates and passport-sized photos.

- Consent Letters from Directors

- Promoters’ Minute and Resolution (if applicable)

4. How can I register my company online?

- Create an Account: Register on the OCR portal (ocr.gov.np).

- Fill out the Registration Form: Complete the online form with the necessary details.

- Upload Documents: Upload scanned copies of required documents.

- Pay Fees: Make the payment for registration fees online.

- Submit Application: Apply for review.

5. What are the fees involved in registering a company?

- Name Reservation Fee: Varies based on the type of company.

- Registration Fee: Based on the company’s authorized capital.

- Additional Fees: These may include fees for document verification and other administrative charges.

6. How long does the registration process take?

- The registration process typically takes 7-10 working days, assuming all documents are in order and no additional information is required.

7. What are the post-registration requirements?

- Obtain PAN: Apply for a Permanent Account Number from the Inland Revenue Office.

- Tax Registration: Register for VAT if your business activities require it.

- Open a Bank Account: Open a corporate bank account in the company’s name.

- Obtain Additional Licenses: Acquire any specific licenses or permits needed for your business operations.

8. What are the annual compliance requirements for companies in Nepal?

- Annual General Meetings (AGMs): Conduct AGMs as per the Companies Act.

- Annual Returns: File annual returns and financial statements with the OCR.

- Tax Compliance: File regular tax returns and comply with tax payment schedules.

- Statutory Registers: Maintain required statutory registers.

9. Can foreign nationals register a company in Nepal?

- Foreign nationals can register a company in Nepal, subject to compliance with the Foreign Investment and Technology Transfer Act (FITTA) regulations and approval from relevant authorities.

10. What is the Office of the Company Registrar’s (OCR) role?

- Regulation and Oversight: The OCR regulates and oversees company registrations, maintains records, and ensures compliance with company laws in Nepal.

11. What are the common reasons for rejecting a company registration application?

- Incomplete Documentation: Missing or improperly completed documents.

- Name Conflict: The Proposed company name conflicts with existing names.

- Non-Compliance with Guidelines: Non-adherence to the regulatory requirements and guidelines set by the OCR.

12. Can I change the company’s name or address after registration?

- Yes, changes can be made by submitting an application to the OCR along with the required documents and fees.

13. Do I need a company seal?

- Having a company seal is a common practice for authenticating documents.

This FAQ aims to cover the key aspects of company registration in Nepal. For detailed guidance and assistance, it’s advisable to consult with legal or professional experts.