Value Added Tax (VAT) in Nepal is a consumption tax levied on the value added to goods and services. Here’s a breakdown of the concept, rules, and filing returns related to VAT in Nepal:

Concept:

- Consumption Tax: VAT is a type of consumption tax. It is borne by the final consumer but collected at each stage of the production and distribution chain.

- Value Addition: VAT is levied on the value added to goods and services. This means that businesses pay tax on the value they add to products or services, rather than on their total sales.

Rules:

- Registration: Businesses meeting certain turnover thresholds are required to register for VAT with the Inland Revenue Department (IRD) of Nepal.

- Taxable Transactions: VAT applies to the sale and purchase of goods and services made within Nepal.

- Rates: The standard VAT rate in Nepal is currently 13%, but there might be different rates for certain goods and services or special categories.

- Input Credit: Businesses can claim credit for VAT paid on inputs (goods and services) purchased for their business activities. This helps avoid double taxation and ensures that tax is only paid on the value added.

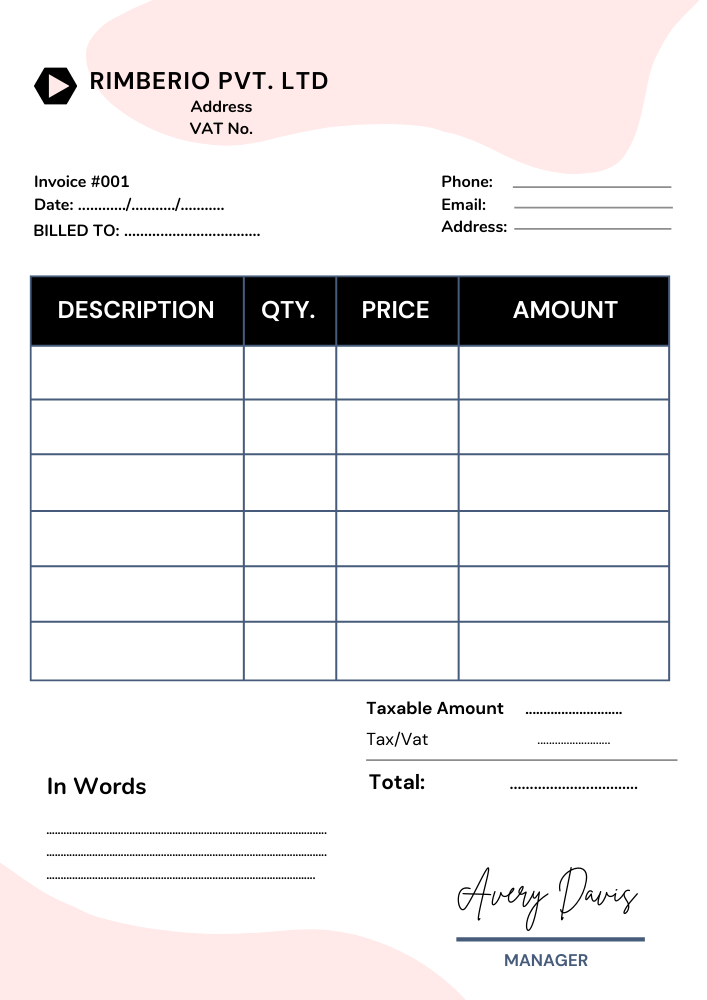

- Invoicing: Businesses must issue VAT invoices for sales made, including specific information such as the VAT registration number, description of goods or services, VAT rate, and amount of VAT charged.

- Filing Returns: Businesses are required to file periodic VAT returns with the tax authorities, usually on a monthly or quarterly basis, depending on their turnover and other factors.

Filing Returns:

- Frequency: VAT returns are typically filed monthly or quarterly, depending on the turnover of the business.

- Due Date: The due date for filing VAT returns is usually within a specified period following the end of the tax period, such as within 25 days after the end of the month.

- Online Filing: In Nepal, there might be provisions for online filing of VAT returns through the IRD’s online portal or other designated platforms.

- Payment: Along with filing VAT returns, businesses must also pay any VAT liability for the period covered by the return.

- Record Keeping: Businesses must maintain accurate records of their transactions, invoices, and VAT payments to support their VAT returns and compliance with tax laws.

Compliance:

- Penalties: Non-compliance with VAT rules, such as late filing or payment, could result in penalties or fines imposed by the tax authorities.

- Audits: Tax authorities may conduct audits or inspections to ensure compliance with VAT rules and regulations.

It’s essential for businesses operating in Nepal to understand and comply with VAT regulations to avoid penalties. Consulting with tax advisors or accounting professionals can provide further guidance on VAT compliance and filing returns in Nepal.