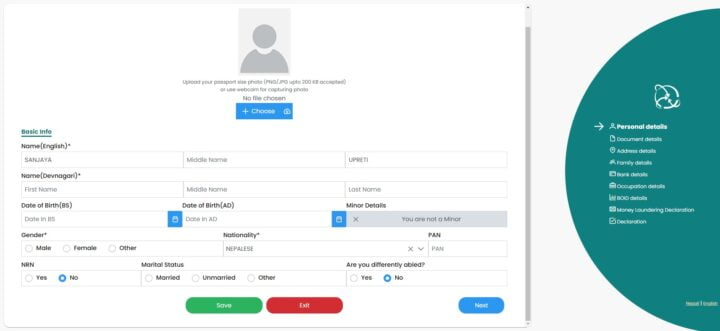

Nepal does not have a centralized CKYC system that is exactly like India’s CKYC. However, the country follows a robust KYC process mandated by the Nepal Rastra Bank (NRB). Here’s a step-by-step guide to the typical KYC process in Nepal, which could serve as a basis for a future CKYC system: Step-by-Step KYC Process in Nepal Customer Onboarding: Application Form: The customer fills out a KYC...