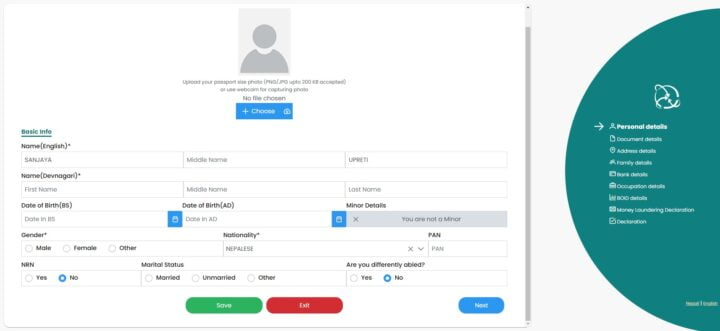

Filling the CKYC (Central Know Your Customer) form online in Nepal involves several steps. The process can vary slightly depending on the specific requirements of the financial institution you’re dealing with. Here’s a general guide on how to fill out the CKYC form online in Nepal: 1. Visit the Official Website Go to the official website of the financial institution or Nepal’s...